By David S. Bauders, CEO SPARXiQ

Integrating Strategies for Market Success

Although over 20 years have passed since the early excitement about the internet, emerging trends and technologies are creating a dynamic new market landscape for distributors. Despite e-commerce’s unfulfilled promises for many, the need for distributors to embrace new channels is more pressing than ever.

At the recent 2024 NAW Executive Summit, several industry leaders joined me on a panel to discuss this transformation, particularly the shift towards omnichannel strategies that align with technological advancements and demographic shifts. Their insights, interspersed throughout this piece, offer a roadmap for navigating this complex landscape.

As Paul Kennedy of Dakota Supply Group notes, “Today, it’s really about meeting the customer where they are and developing a frictionless experience across all of the different channels, whether that’s online or offline, at their shop, on the project site, whatever the case may be, but finding ways to ensure that we’re developing solutions to provide that seamless and frictionless experience across all those all the vendors.”

Emerging Trends and Technology Adoption

The marketplace is changing partly as a result of improvements in digital technologies and the platforms they support, enabling rich content delivery through enhanced broadband capabilities. In addition, a major demographic shift is bringing a new, digital-native generation of workers into distribution markets. Finally, increased digital adoption is fueling the evolution of marketplaces that are truly customer-centric in their orientation and value-proposition.

The North Star of omnichannel is to always meet your customers where they are: to understand how and where they want to buy from their suppliers. So, changing buyer demographics are now creating an omnichannel imperative for distributors. The shift from the traditional sales channel, comprising outside sellers, inside sellers (CSRs) and websites, is quickly evolving towards one that adds to the mix marketplaces, EDI/e-procurement, as well as proactive, outbound-calling business development reps.

Buyer Preferences and Channel Evolution

Customers’ channel preferences vary widely, depending on factors such as user roles, products, application scenarios, and whether purchases are made in the field or office. Traditional sales roles are adapting to this reality, with a focus on personalized service for complex buying scenarios that meet the ANCR criteria: products, projects or applications that are Ambiguous, New, Complex or Risky. In these scenarios, digital commerce is more complicated — though these will tend to diminish over time as buyer tools evolve to resolve the most common challenges.

For distributors to migrate to a competitive advantage in omnichannel, two complex transformations are critical. First, distributors need to rationalize their traditional sales teams according to the natural boundaries of digital vs. ANCR commerce. Transactional data analysis can help model the current and likely future shares of customer spend, as well as highlight key customer clusters to focus upon. In order to support a robust go-forward sales org structure, sales competencies and sales DNA must be mapped against key roles.

Secondly, distributors need to focus on and invest in the technologies, capabilities, and marketplace resources to outcompete their peers. These investments will be key to capturing share in next-generation buyers’ wallet share.

Sean McCloskey of WESCO elaborates on this point, highlighting the broader implications of digital adoption: “Implementing technology is an opportunity for change – to better our processes, to create new roles. So, I would encourage everyone to think of it as more than just ‘it’s an e-commerce channel’. It’s a digital approach to your customer. What pieces of that approach do you need to implement back of house, and front of house, to actually execute better and be where they want to be?”

Preparing for and Funding Omnichannel Strategy

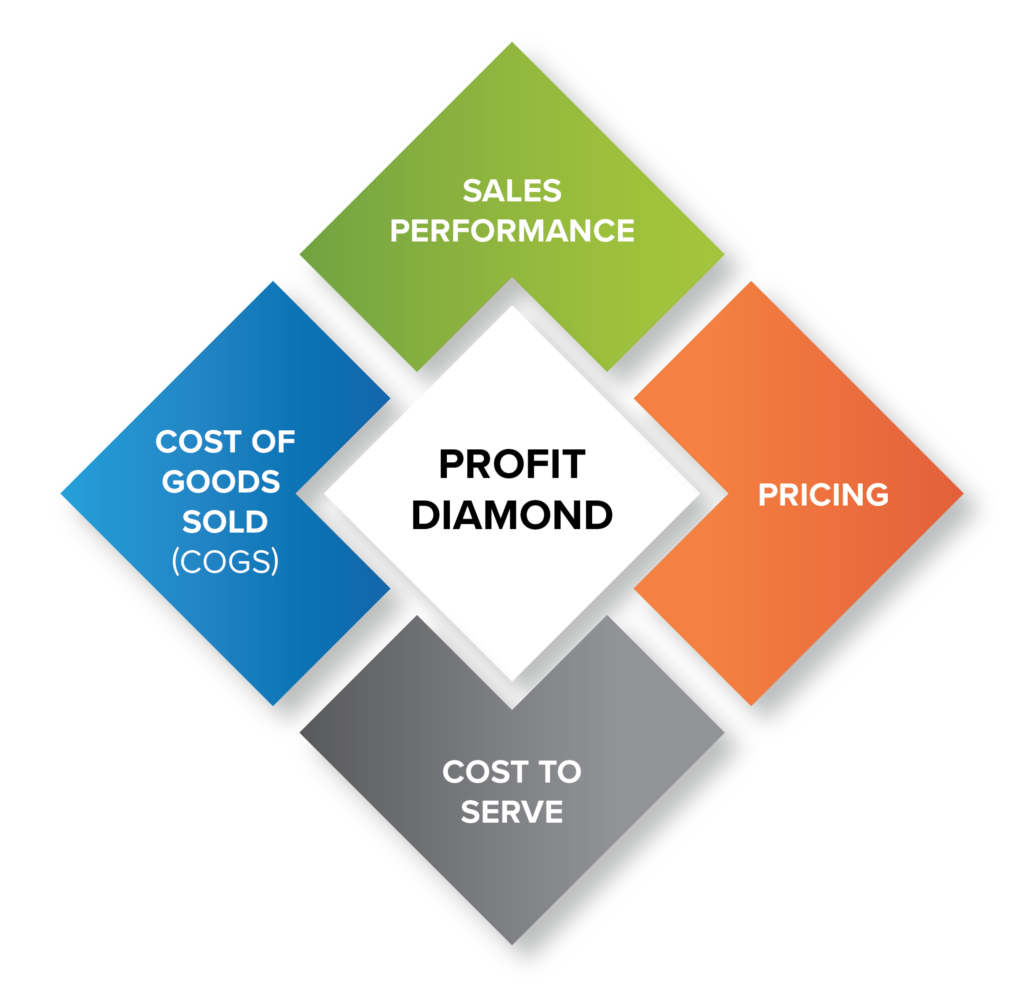

To fund the significant investments in omnichannel, as well as to prevent unnecessary friction for customers crossing channels, it’s critical for distributors to master what we call The Profit Diamond: the four levers that drive current and future profitability.

- Pricing: Implementing strategic pricing practices ensures consistency across channels, enhancing customer experience and preventing price arbitrage as businesses transition to omnichannel.

- Sales: By using analytics to understand customer market baskets and channel preferences, sales teams can proactively capitalize on digital demand and uncover new revenue opportunities.

- Cost of Goods Sold: Establishing robust sourcing strategies with consistent costs and strong vendor relationships is crucial to delivering a competitive omnichannel experience for customers.

- Cost to Serve: Gaining a transparent view of service costs allows distributors to align pricing and service models with based on the value delivered to different customers.

Market-leading companies are accelerating their optimization of these four levers, not only to support the omnichannel data imperative but also to fund the investments required in digital capabilities and sales org restructuring. Stu Tisdale of ADI Global particularly highlights the strategic importance of pricing, “If you really want to polish up your change management skills, pricing is a great place to start. And the margins you’ll get will allow you to invest more in your tech stack.”

Evolving Sales Roles for Efficiency

The omnichannel model requires right-sizing of the traditional sales roles, as well as the addition of emerging roles, such as Business Development Reps and Marketplace Managers, who are pivotal in driving omnichannel growth.

New sales roles will require new competencies, new sales systems and new approaches to compensation. Proper sales competency assessments can help identify which current or prospective sellers have the appropriate Sales DNA and learned sales competencies to succeed in both legacy and new sales roles. As Bob Decker of Livingston & Haven succinctly puts it, ‘We often will teach our salesmen and saleswomen the technical side of the product, but we don’t teach them how to sell,’ underscoring the need for a new sales paradigm.”

Harnessing Analytics for Customer Insights

In order to track and manage customer success in an omnichannel world, distributors need a complete view of customers’ buying practices across all channels, legacy and new. Once again, the distributor’s success will be aided or hindered by the state of their data and analytics. Account managers in an omnichannel environment need the 360-degree view of customer spend in order to measure current performance, set future goals, and provide appropriate account-coverage models to drive sales execution.

Stu Tisdale expands on this point in the way ADI Global thinks about it, “I think when you see some of your top salespeople say, ‘Hey, I want the data of my customers online’ and actually using it, that you’re driving the adoption.”

Sustaining Growth: The Profit Flywheel Effect

On the road to omnichannel excellence, progressive distributors are investing in deep mastery of the analytics and profitability of the Profit Diamond. Early investments in strategic pricing often lead the way, as they are key to spinning up profit improvements and preventing omnichannel friction. Sales analytics, while not having quite the leverage effect of pricing, are key to supporting new sales roles and the 360-degree view into customer profiles. COGS and Cost to Serve set the stage for alignment of pricing with relative value across omnichannel, as well as capturing new efficiencies.

Embracing omnichannel is not merely a strategic adjustment but a fundamental transformation that requires a deep understanding of technology, market dynamics, and customer expectations.