By: David S. Bauders, CEO SPARXiQ

Even before the pandemic, the forces of change were looming large in wholesale distribution. New generations of buyers were changing how they buy and what they expected from distributors — which in turn, was forcing a wholesale transformation of the modern distributor. The post-WWII distribution-center-with-local-branches model was showing its age. Digital technologies — including e-commerce and digital customer buying platforms — have been slowly but inexorably growing and shifting the modern economic imperative for distributors.

The magnitude of this transformation is difficult to overstate, in terms of time, complexity and financial and organizational requirements. In this post, I’d like to share an emerging trend in how leading distributors are funding the development of the business capabilities needed to profitably serve the modern marketplace. The magnitude of the transformation is truly astonishing.

Shortcomings of Traditional Distribution Models

Over the last five years, as the SPARXiQ team has worked with distributors across diverse vertical markets, some key obsolescent conditions commonly emerged — in a pattern called The Plague of Sameness — in their businesses:

Fragmented, Inefficient Branch Structure: This structure positions inventory in a highly decentralized local network, often with redundant stocking points in each metro market. Beyond high cost-to-serve, this model also lamentably assigned branch managers to lead sub-scale sales teams. (All it takes, as the joke goes, to prevent sales coaching on any given day is a flat tire on the delivery truck.) The branch network costs 10 to 15 percent of revenues, perhaps half of gross profit dollars.

High-Touch, High-Cost-to-Serve Sales Structure: Often decentralized, routine customer quotes and orders are received via telephone (or text) by CSRs who manually enter them into the ERP. In the field, outside sales reps randomly call on customer locations, essentially asking customers (with little, if any, prospecting) if they’d like to buy more from them each day. Lacking process, insights, tools or training, sellers are indiscriminate order takers rather than strategic market makers. As a result, sellers produce a roulette wheel of net profits vs. net losses, stagnant/falling growth rates, and suboptimal vendor/product-mix/share-of-wallet. The sales team costs 10 to 20 percent of revenues, one-third to two-thirds of gross profit dollars.

Decentralized, Wild-West Purchasing: With a quarter to a half or more of purchasing decisions made locally, without tools, training or technology, purchasing is a similar roulette wheel of performance in a business that commonly makes less than ten percent EBITDA versus revenue — failing to optimize customer- or project-specific SPAs and volume-based rebates from vendors. With average gross margins of 20 to 30 percent, sell-side cost variability is commonly (depending on distributor vertical) 10 to 30 percent inefficient.

Decentralized, “Wild-West” Pricing & Profitability: Leave ‘Em Alone and Let ‘Em Sell. Usually, Decentralized and branch-based sales organizations lack the strategic pricing tools, training, processes, culture, and technology to capture the value the bring to their customers. Relying on Cost-Plus and not understanding the true importance to their customers of price versus value, they leave mountains of gross profit on the table with their customers, which is commonly half or more of the available profit in their business.

As these antiquated, unstructured business levers interact and compound, they eat up an enormous share of potential profitability, rendering the distributor incapable of investing in value-adding capabilities that modern buyers demand. This essentially suppresses an organization’s migration into the future, rendering it acquisition bait for private equity and evolved market leaders. These distributors are likely to eventually be bought out by market leaders who have invested in business transformation — often at a discounted or even scrap-value price.

Leveraging the “Flywheel” Playbook

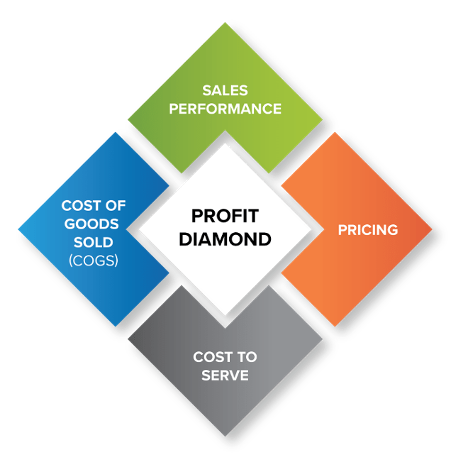

How do you migrate from the “Plague of Sameness” to become a “Strategic Market Maker?” Progressively invest in the optimization of each Profit Diamond lever, investing the resulting proceeds into business transformation (which yields new revenues and profits for further transformation and/or acquisition).

- Start with the most valuable profit lever, Pricing. Providing the tools, process, training, and technology to sellers to capture more of the leaking customer value of today’s business model can quickly and efficiently yield 200-400 basis points on affected revenue ($2m to $4m per year per $100m of revenue) while building process disciplines to support further optimization and transformation.

- Next sharpen purchasing and rebates. Providing the tools, process, training and technology necessary for buyers to optimize purchase prices can quickly and efficiently yield, depending on industry vertical, 140 to 280 basis points on revenue ($1.4m to $2.8m per $100m).

- Drive sales excellence and transformation to greater revenue growth and productivity. Digital transformation new sales coverage models, processes, talent selection & development, account management, formalized call planning, optimized target selection, and compensation systems can yield revenue gains and/or productivity gains and help you align with changing marketplace demands, as mentioned above in this article.

- Implement cost-to-serve innovation and restructuring. Rationalize/right-size branch networks versus fulfillment centers; implement/expand e-commerce and participation in purchasing platforms; prune unprofitable customers, vendors, branches, verticals.

- Invest in services that build customer value and competitive differentiation. Value-added services increase customer value and retention, pricing power and leverage vs vendors, and create defensibility vs. Amazon and other platforms.

Distributors who optimize the Profit Diamond and extract more value from their existing business model have the resources and process disciplines to invest in business transformation and acquisition. This means they have an advantage in being the first to attain viable economic scale in the new market landscape. Each stage in the Flywheel yields resources and process capabilities to invest in and execute the subsequent stages.

Start the Business Transformation Journey

With new capabilities and increased profitability, evolved distributors can realign their businesses away from the Red Oceans markets defined by the “Plague of Sameness” and migrate to Blue Oceans markets of increased customer value, growth rates, profitability and resulting scale and enterprise value. For those select distributors who are committed to and executing the Flywheel playbook, the business transformation will make it better to be their customer, harder to be their competitor, and better to be their stakeholder.

David S. Bauders

As CEO of SPARXiQ, David Bauders has been committed to helping companies accelerate sales and profitability with the right analytics, tools and complementary skills training since he founded the company in 1993.