By David S. Bauders, CEO SPARXiQ

For many distributors, the post-pandemic period has provided exceptional growth, with many sectors experiencing revenue gains of 30 percent or more since 2021. Though part of this growth has been driven by persistent high inflation, much of it was fueled by real expansion in volumes due to increased construction and economic growth. In many sectors, 2022-2023 has seen record sales and profitability.

Growth has not been equal, however. For many distributors, their sales and profit growth, while internally impressive, actually show a loss of market share when placed in the context of total market growth. A distributor with 10 percent growth in a market that has grown 20 percent, for example, has clearly lost share. Such distributors are either not aware of their market positioning, or believe they are different.

Competitive Dynamics and Customer Strategies

The reasons for market share shifts are diverse. Sometimes they are based on capabilities-based competitive differentiation, including:

- E-commerce

- Logistics

- Customer service

- Selling systems

- Vendor management

In other cases, such as those where competitive parity prevails, a different dynamic is at work. When competitors’ in-stock availability, geolocation, and service are essentially equal in the eyes of customers, pricing will tilt the outcomes and shift share.

For supplier-security and diversification reasons, most customers prefer to have a few key suppliers. Buyers want to have options, so their multi-sourcing strategy is to award a number one position based on value (potentially price in parity situations), with secondary and tertiary positions for others. For example, they may award 40 percent to the lead supplier and maintain numbers two and three at 20 percent each (with the remaining 20 percent distributed across five to seven tertiary, fill-in specialists).

The Role of Bids & Quotes (B&Q)

In many industries, these positions are won or lost in the B&Q segment of buyer spending, where competitive quotes are put out to bid, gathered and compared to pick a winner. Consistent winners of B&Q usually also capture associated tail-spend that is off-quote; and they ultimately capture the lead position and relegate their competitors to secondary or tertiary positions.

For distributors in these markets, mastery of this dynamic requires exceptionally sharp customer-facing pricing as well as vendor rebate capture. Vendor rebates may reduce the costs (and implied pricing) by a range of 15 to 30 percent versus standard into-stock costs. A distributor that underclaims or fails to request eligible rebates will lose B&Q revenue and associated primary-supplier positions.

Optimized vendor rebates enable aggressive, winning pricing in B&Q spend; premium pricing and margins are applied to non-B&Q tail spend. For winning distributors, vendor rebates and aggressive pricing subsidize the acquisition of leadership position; and dynamic pricing captures the margin “spoils” of tail spend and rebalances profitability.

Going Granular with Strategic Pricing

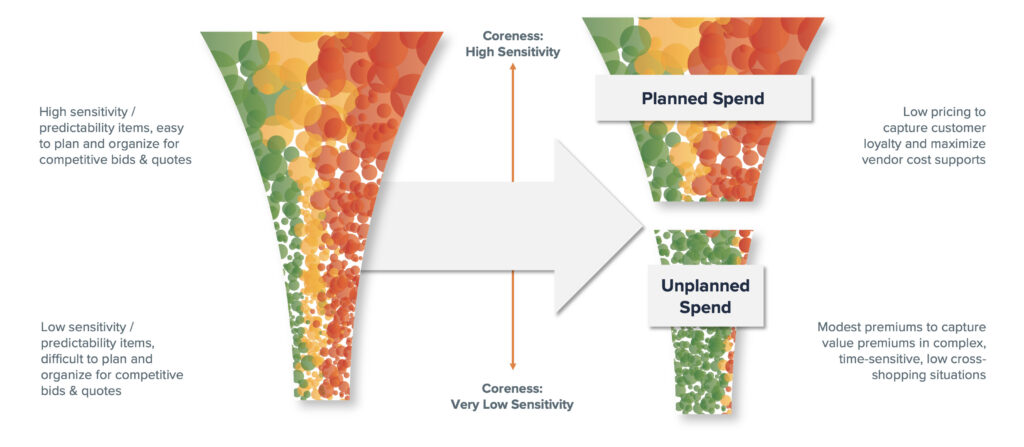

On the pricing side, typical two-dimensional customer segmentation and broad-brush product margin standards don’t provide the differentiation needed to win in this competitive dynamic. Simplistic pricing models like these lead to low-resolution pricing positions that under-perform in both the most competitive market segments (where they aren’t aggressive enough) and in the least sensitive segments (where they leave precious margin dollars on the table).

The key to developing a better pricing strategy is adopting the multi-dimensional perspective, where higher-resolution customer segmentation and SKU-level sensitivity profiling yield a sharper pricing structure. The 4D approach is both more competitive on core products and more profitable on non-core products.

Achieving this level of precision in a pricing architecture leads to higher usage rates by sales teams, trusting the pricing system to quote instead of resorting to manual overrides or customer-specific pricing records. SPARXiQ’s analysis of hundreds of distributors’ invoice data shows that use of these alternative pricing methods reliably reduces margins by 7-10 points.

As profitability stagnates or declines in this shifting economy, it’s time to look at how your pricing system hinders or accelerates your market position and profitability. Pricing overrides are a primary indicator of immature pricing tools. Investments in pricing and rebate optimization will determine the winners and losers of the struggle for market share and breakout profitability.

Optimizing Vendor Cost Support

On the vendor cost-support side (SPAs and claim-backs), the Wild-West sales approach of most distributors places primary responsibility for requesting vendor support on frontline sellers. These sellers are over-stretched and lack the perspective and analytics to understand how to request the appropriate cost support necessary to win highly competitive Bids & Quotes scenarios.

Facing dozens of vendors with disparate and highly variable rebate approval levels, the typical distribution sales force underclaims rebates by about 30 percent, with pervasive leakage due to missing customers, missing products, and sub-optimal support levels on existing programs. This leakage is a blow to both profitability as well as market share, where the missing cost support relegates the distributor to secondary or tertiary positions.

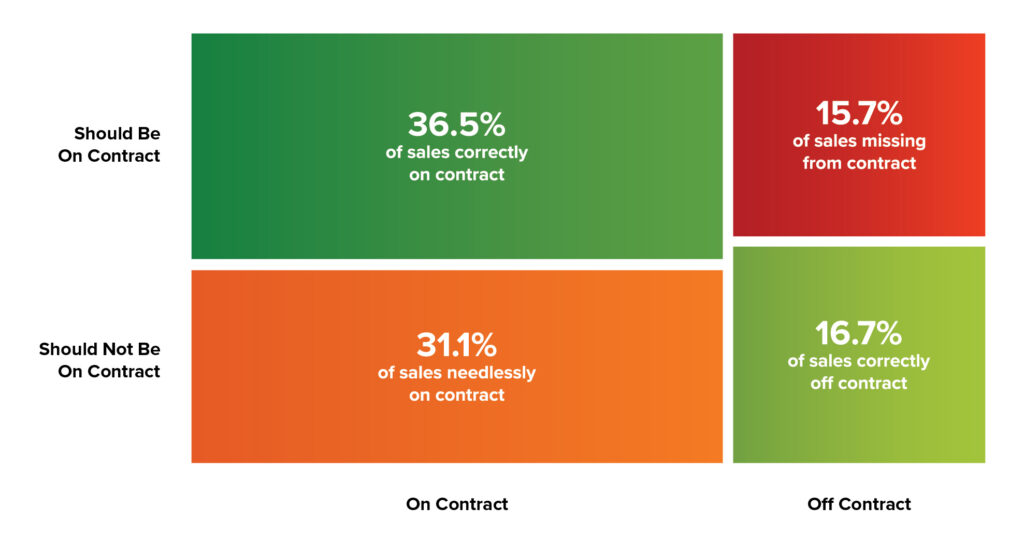

The Bids & Quotes environment requires the distributor sales team to master Customer-Specific Pricing, where the structure of pricing agreements is set. Many sellers lack the analytical insights to develop appropriate CSP pricing. They miss critical, sensitive products that may not appear in the customer’s sales history, which means they overprice them and fail to secure appropriate vendor cost support. Conversely, sellers often inappropriately include tail-spend products which should have been kept off-contract to secure compensating margin premiums. Sloppy CSP pricing makes it difficult or even impossible for sellers to secure primary source positions.

In a data study of a large distributor’s contract records, SPARXiQ found that 53% of sales were correctly priced; 46% of contract sales should not have been on contract (“Needless”) and 48% of off contract sales should have been on (“Missing”).

Integrating Strategies for Market Success

If your company has rough parity with your competitors but is struggling to grow faster than the markets you compete in, it’s likely that your buy-side cost supports and sell-side pricing are too simplistic or disconnected from each other. An effective and integrated buy-side and sell-side pricing architecture can help you recover your position and capture maximum value from your customer relationships, while providing the scale and resources to invest in competitive differentiation.